Today the Federal Reserve meets and is likely to announce a 1/4 raise in rates. This would be the 13th straight time the Fed will have raised rates. Of course now that the street is expecting a 1/4 point, the actual language that is used becomes the catalyst for the immediate market direction. The market was not interested in making a move prior to this announcement yesterday and today it appears to be on the same path. A path to nowhere.

Combining the Fed meeting with the fact that this week is options-ex, it would probably be a good thing to stay in cash for the short term. Therefore, I'm long the December QQQQ 42 puts! Trader Mike stays out of the market altogether during options-ex week. Here is a good description as to - Why I Avoid Options Expiration.

Good trading!

A trading journal site following the in's and out's of the trading day through my eyes. Market sense and commentary. In no way should this be interpreted as a site for recommendations or stock picks. If you treat it as such, do so at your own risk and may God have mercy on your soul.

Tuesday, December 13, 2005

Monday, December 12, 2005

Success at last

I finally had a good trade. I bought the December 42 Puts for $0.50 and sold them for $0.75. I kept moving my stop order up as the put value increased and then got stopped out. Actually it appears the market center incorrectly filled my order as the stop should not have triggered, but as the put value dropped thereafter, I was okay with that.

This trade was fairly good for me on many levels. First, I followed the RSI (5) trading rules and secondly I was strict on using a stop to protect my position. For my last 4 trades I have put a stop on and all have been stopped out and only the last one for a gain. However, this is not a bad thing as it actually saved me money by not getting bigger losses on the 3 previously stop outs. Looking for another short now as I missed the last buy signal. The Q's are at $41.85 right now and RSI (5) is at 75. Looking for a 76 RSI value and then a cross of the price line with the SMA (2) to go short.

This trade was fairly good for me on many levels. First, I followed the RSI (5) trading rules and secondly I was strict on using a stop to protect my position. For my last 4 trades I have put a stop on and all have been stopped out and only the last one for a gain. However, this is not a bad thing as it actually saved me money by not getting bigger losses on the 3 previously stop outs. Looking for another short now as I missed the last buy signal. The Q's are at $41.85 right now and RSI (5) is at 75. Looking for a 76 RSI value and then a cross of the price line with the SMA (2) to go short.

Friday, December 02, 2005

Confused Trader

It's been awhile since I've posted about the market and my trading. This is due to the fact that I have been in a funk with my trading as of late. It probably would have been better for me to post about this as it was happening, but instead I just didn't want to think about it.

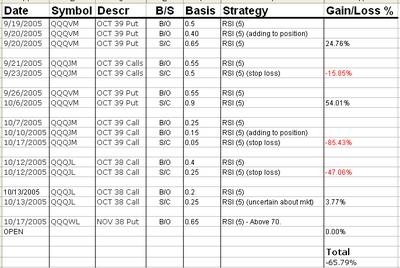

I've been trying to following the Nocona RSI (5) system and seem to get the wrong end of the trades. Of course it still seems to be working, but I'm either stopped out or I jump in on the few drawdowns it incurrs. Great. Anyway, the market went up up up and I was short and then when I got out I just kept watching the market rise while not playing the long side. Currently, I'm trying to go short again with the Q's around 42. 42!!!!! are you kidding me! My biggest loss was just a while ago while I held the 42 calls...those would be worth a bundle right now. Oh well. Live and learn.

I've been trying to following the Nocona RSI (5) system and seem to get the wrong end of the trades. Of course it still seems to be working, but I'm either stopped out or I jump in on the few drawdowns it incurrs. Great. Anyway, the market went up up up and I was short and then when I got out I just kept watching the market rise while not playing the long side. Currently, I'm trying to go short again with the Q's around 42. 42!!!!! are you kidding me! My biggest loss was just a while ago while I held the 42 calls...those would be worth a bundle right now. Oh well. Live and learn.

Friday, October 21, 2005

Confused Market

The last two days the market has had big days. Wednesday was a big move up and then Thursday was a big move back down. Yikes! Unfortunately I've been expecting a really big move down and am long Nov 38 Puts (QQQWL) and have missed out on playing the range. The RSI (5) system would have allowed me to really scalp some great returns, but I have backed away from that method shortly. Yesterday the Q's opened around $38.70 and then dropped to $38.24. As of right now (6:20 am PST) the Q pre-market trading is $38.50. Today will be interesting.

Tuesday, October 18, 2005

Tuesday Oct 18

The market has done the predicted bounce up over the last 3 trading days, but on light volume. This would seem to validate the indication that this is simply a bounce and not a bull move. I'm betting on it being a bounce before we head down, and head down quick. Also, the RSI(5) system triggered a short signal yesterday. I bought the Nov 38 Puts right when the Q's were trading around $38.05. The Q's meandered around the $38 level yesterday, reaching a low near $37.80 and then closed the day above $38 to $38.15.

This morning the pre-market showed a significant upmove as I saw QQQQ trading above $38.22 but in the last 30 mins they have settled closer to $38.07. I'm not sure what this says for the trading day ahead. But if the SPX can't break the 1200 mark, I see a down move coming sooner rather than later.

This morning the pre-market showed a significant upmove as I saw QQQQ trading above $38.22 but in the last 30 mins they have settled closer to $38.07. I'm not sure what this says for the trading day ahead. But if the SPX can't break the 1200 mark, I see a down move coming sooner rather than later.

Thursday, October 06, 2005

Closed out the Oct 39 Puts

Today the market rallied in my favor, which was basically a day of all red on my computer screen. The Q's dropped around $0.80 today to hit a low of $37.92 only to make a decent pop back up to close at $38.32...only $0.44 down. However, this move gave me some nice profits that I finally did cash in on. I sold my puts for $0.90 for a $0.45 gain overall. I tried to get out when the Q's were tanking and QQQVM was $1.15/$1.20 but as usual I waited to long and then lost another 20 cents or so. However, it's a good gain and as previously noted I was down big earlier this week. Nice comeback and perhaps a lesson learned. STOP OUT instead of hanging on.

Tomorrow should be interesting and I may just hang by the sidelines. Good trading!

Wednesday, October 05, 2005

401k a bad thing?

Mr. Robert Kiyosaki in his article "Work Hard, Earn Less?" puts forward some interesting thoughts on taxes and your 401k. Something I haven't thought about before, that is.

The safety net the 401k provides is nice and the upfront tax break from contributions is also a plus. But it may not be the best bet in the long run.

Mr. Kiyosaki points out the following:

Today, workers who save money and invest in a 401(k) plan are the highest taxed people in America. Now, I can hear some of you asking, "Isn't saving money and investing in a 401(k) having your money work for you?"No -- at least not according to the IRS. A worker's pay is taxed at the highest tax rate possible. So are your savings and income from your 401(k). In most cases, money goes into a 401(k) tax-deferred but comes out as highly taxed ordinary income.One of the reasons the rich are getting richer is because they have more control over our number one expense: Taxes.

The safety net the 401k provides is nice and the upfront tax break from contributions is also a plus. But it may not be the best bet in the long run.

Current trading position

Okay....I am totally breaking the mechanical trading method and am looking to recoup my losses. Therefore I didn't close my short positions (long Oct puts) and I didn't switch to going long as the RSI(5) method dictates. I am looking at a new method for entering a trade and will post on it shortly with a detailed chart. The Q's and the market went down fairly well yesterday with heavy volume.

Tuesday, October 04, 2005

This Man Has Studied Program Trading For 23 Years

Tradingmarkets.com has a great interview with Hank Camp of HL Camp and Company. Mr. Camp discusses arbitrage through program trading and his extensive studies of the market Since 1982. One particular note of interest is the breakdown of how the OEX options are manipulated during options expiriation. Manipulation may seem like a conspiracy type mindset, but once you read the breakdown it doesn't seem odd at all.

Friday, September 30, 2005

OUCH! Breakout and missed opportunities

The market finally decided to break out of the recent trading range and went up up up. Not good for my put position. The issue was the lame range the last week and not getting a confirmation to close to Put/short position. However, RSI(5) was VERY close to being below 30 on the hour and I did set a limit order to sell at $0.75 but didn't get a fill. Mostly I was expecting a bigger move down but we didn't get it. The Q's were around $38.45 yesterday and that's when I should have taken my profits and closed this dreadful short that just wouldn't materialize.

The RSI(5) system doesn't really afford the chance to let the profits "Run" so when I got the $0.20 to $0.25 profit I should have taken it. Currently Q's are up AGAIN today and currently around $39.36 and hitting a high of $39.45. Some are mentioning that this current run up is due to end of month and funds/institutions trying to prop up their value. Who knows.

Thursday, September 29, 2005

Narrow Trading Range - Ready to Break?

The last few days the market and the Q's specifically have been in a narrow trading range and probably just setting up for a break out one way or the other. The question is which way. I don't see much upside potential...but maybe that's just because I'm currently sitting on puts. We will see soon I suspect.

The last two days the Q's have opened at $38.78 and $38.76 repsectively and closed at $38.67 both days also. That's a bit weird. Both days the RSI(5) hasn't closed an hourly bar below 30 or above 70 and therefore I've stayed put with my bearish inclination in the short term. Hopefully today we will have a good move. The futures are currently pointing down a bit and pre-market trading on the Q's is around $38.68.

Wednesday, September 28, 2005

Trading position update

Holding long the Oct 39 Puts (QQQVM) purchased at $0.55. Yesterday the Nocona RSI (5) system came VERY close to signaling a cover, but it never quite got there. This is an example of maybe a time to override the system and get out as my profits would have been around the $0.20 to $0.25 profit range (per contract). This profit range is about the max you can expect without an opening gap in your trading direction. This morning the futures popped up and the Q's opened around $38.80 after closing yesterday at $38.67. I'm still on the short side.

Trading Journal

Since this site is primarily my trading journal, I thought it would be appropriate to post an article on this subject as well. I certainly have a few things to improve.

Tuesday, September 27, 2005

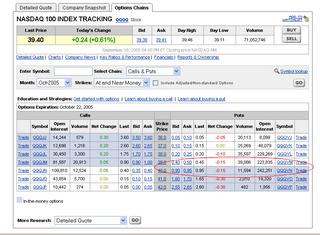

Interesting read on the Q's

This article has some interesting points on the market and QQQQ specifically.

Current position

The market is fluxuating around being flat this morning and the Q's are currently at $38.73. I'm still long the Oct. 39 puts at $0.55 (QQQVM) and they are trading at $0.60/$0.65. The RSI (5) is at $61.71 and yet the Q's are still drifting lower. I like the quick down moves and then a little move up to keep the RSI above the 30 level. This allows me to hold the profitable position longer being a signal to cover. Let the profits run!!!! Good trading!

Monday, September 26, 2005

Short the market - Oct 39 Puts

At the open I purchased the Oct 39 puts at $0.55 each. The RSI (5) system signaled a short at the close on Friday but I waited until the market open and gap up before getting in the mix. Currently the Q's are below $39 (high of $39.03 today) at $38.92.

Rita concerns over - Market looking up.

Rita didn't seem to devastate TX and LA as previously worried and therefore the market is rising in premarket trading. Although I left some money on the table by getting out on Friday, the RSI (5) system indicated a sell and reverse to short. I will be looking for a short signal soon as I don't think this up gap will hold.

Saturday, September 24, 2005

Closed position - In cash

The RSI (5) system indicated an hourly bar above 70 (hit around the 80 mark) in the last 1 1/2 hours of trading on Friday (9/23/05) and I closed out my long calls for a $0.05 per contract loss. Not much of a loss really and I may have got out 'even' on the trade but I didn't want to work my limit order and instead just took the bid price. Also, I was worried about the impending action on Monday following hurricane Rita. Hurricane Katrina ripped me apart and I can't afford that kind of loss again. Also, the RSI (5) hourly system signaled to sell the long position and triggered a short. However I'm all in cash.

Thursday, September 22, 2005

Sept 22 - Still....long Oct 39 Calls

What a wild ride for the Q's today. The market opened down a bit from yesterday and then dropped from $39.48 to around $39.23. Suddenly the market bounced up to around $39.60 + and then back. That continued until about the last 2 hours of trading where the market went higher. Not high enough to take a profit and the Oct 39 calls I am in (at $0.55) ended the day at $0.50/$0.55. I was so close to pulling the trigger to stop my loss today but I held on and I am a bit distressed about holding my calls as hurricane Rita makes headway towards Houston. The RSI (5) Hourly ended around the 50 mark. All things considered, I will most likely exit the position tomorrow regardless of the signal due to Rita. I am thinking about a put trade as a gamble with Rita. To be continued...

Wednesday, September 21, 2005

Long Oct 39 Calls through the close

The market ended down as follows:

DOW: 10,378.03 -103.49

NASDAQ: 2,106.63 -24.70

S&P 500: 1,210.20 -11.14

QQQQ = $38.47

QQQJM = $0.45/$0.50

I stayed long the Oct 39 calls and am getting closer to stopping my self out. I couldn't hold through another down day like today.

DOW: 10,378.03 -103.49

NASDAQ: 2,106.63 -24.70

S&P 500: 1,210.20 -11.14

QQQQ = $38.47

QQQJM = $0.45/$0.50

I stayed long the Oct 39 calls and am getting closer to stopping my self out. I couldn't hold through another down day like today.

Long Oct 39 Calls

I went long the Oct 39 Calls at $0.55 just around 10:50 am EST today. The market continues down however. I'm just looking for a small move up to take advantage of it. We will see. Currently I'm down $0.05 on the options as QQQQ is trading at $38.64/$38.65.

Wednesday Trading....down?

Today's futures are pointing down so far, and the Q's are currently at $38.78 in premarket trading. Hurricane Rita seems to be heading for land and looks mammoth when viewed on TV. They show the big swirl on TV with those vibrant colors and the entire storm takes up just about the entire Gulf. We'll see how the Hurricane and the Fed announcement move the market. Personally, I feel a move downward right now and am feeling a bit upset about selling my Puts. However, I've decided to make small gains every day instead of going for that big trade.

Tuesday, September 20, 2005

Making profit$

I started today still holding my Oct 39 Puts and the market gapped up fairly well against me. The Q's traded above the $39.50 range but seemed to waffle a bit around that region in anticipation of the Fed announcement. The RSI signaled to "cover" prior to the market close yesterday and the reversed to a "long". I didn't follow and hence was down some today as the market rallied in the direction the RSI(5) predicted. The system then triggered a sell signal around $39.51 and immediate "short" at the same price. I loaded up again on the Oct 39 Puts at $0.40 prior to the Fed announcement. The market whipsawed after hearing the 0.25 rate hike news but then decided to tank and the Q's dropped below $39.00. I got out and went fully to cash, selling the puts for $0.65. Nice profit. The RSI(5) signaled two winners today, of which I partially benefited. Currently the system reads "long", but I am hestitant to hold overnight right now. Better safe than sorry and I don't ALWAYS have to be in a trade.

Fed Raises rates 1/4 point

No surprise to me, but the Fed just announced that they are raising rates a quarter point. So far the market is mixed on the news but and will probably wait to see the "sentiment" of the comments made by Greenspan. I'll long Puts still. Hoping for a little downward move.

Futures up and wishing

Futures are pointing up and the market will probably go up as well this morning. Typical for fed announcement day is for a morning rise and afternoon fall.

The RSI (5) Hourly signaled to sell yesterday and then go long. I did neither and am wishing I had followed the system like. However, we will see today. Q's are down to $39.16 in pre-market from their high of $39.25. Market opens in 1 min.

The RSI (5) Hourly signaled to sell yesterday and then go long. I did neither and am wishing I had followed the system like. However, we will see today. Q's are down to $39.16 in pre-market from their high of $39.25. Market opens in 1 min.

Monday, September 19, 2005

Still holding Oct 39 Puts

The market closed today with the Nasdaq down 15.09, the Dow down 84.31 and the S&P down 6.89. I stayed in my position of being long the Oct 39 Puts although I attempted to liquidate at $0.65 within the last hour to the close. Uncertain news is coming out tomorrow (Fed meeting and possible rate hike) and the unknown of another hurricane makes this position a bit...Shaky. Also, my trading system signaled a sell and then signaled going long...both of which I ignored.

The reason for having a system is to follow it and take some of the decision making out of the way. However, my big issue is with daytrading in a cash account and worrying about settled funds for getting back into the position tomorrow if needed. Probably a bad idea. I'll try again tomorrow.

The reason for having a system is to follow it and take some of the decision making out of the way. However, my big issue is with daytrading in a cash account and worrying about settled funds for getting back into the position tomorrow if needed. Probably a bad idea. I'll try again tomorrow.

Did not Cover bearish position

I am still fiddling with this trading system and I can't trade as short term as it signals. I closed out my order to cover and stayed long the puts (bearish). Good move as Q's dropped below the $39 mark and are currently at $38.93. Staying bearish but i would like to close position before mkt close.

Attempting to cover short position

Mid morning update

QQQQ is still slowly falling, which is fine with me. Currently the Q's are trading at $39.11/$39.12 and the QQQVM (Oct 39 puts) are at $0.55/$0.60. 10% up already. I didn't invest a large postion size as my risk would be too large. This system should setup for about 90% in actual QQQQ stock and the other 10 percent in options while holding a 2% stop on the stocks. It's tough to gauge the stop parameters for the options as a 2% move in the stock can relate to a 50% move in the option. Especially when you're playing them ATM (at the money).

Long Oct 39 puts

I purchased the Oct 39 Puts at $0.50. Not really happy about that as I was trying to get filled at $0.40 on Friday and then again this morning. I moved the price up to $0.45 as the market showed $0.45/$0.50. Getting filled off the bid isn't that odd, but with the massive amount of volume on the Q's...it can take awhile. Then you're just chasing the position. I KNOW I want to be short (or long puts) so this isn't really a time to chase. But I know every $0.05 of options movement is a few bucks. QQQQ's were $39.30 at the time of my fill, currently they are falling slightly and the overall market seems to be turning red. Down we go? My system says so.

Futures pointing towards a lower market open

The futures are all pointing to a lower open today, although just barely. However, QQQQ are trading pre-mkt at $39.35 and they closed Friday around $39.40. So maybe they will show a slight pop at the open where I can get into the Oct 39 puts at a reasonable price. The first hour of trading is often a whacky time and seems to be more volatile. Let's hope for the best.

Sunday, September 18, 2005

QQQQ RSI (5) Hourly - Signaled "SHORT"

The QQQQ RSI (5) Hourly signaled a short just prior to the close of trading on Friday, 9/16/05. The QQQQ's kept rallying up the last hour of the market most likely due to "Options Ex".

Rules for Nocona's "QQQQ/RSU 5 Hourly"

- When the RSI 5 closes an hourly bar below 25...buy QQQQ

- When the RSI 5 closes an hourly bar above 70...sell QQQQ

- When the RSI 5 closes an hourly bar above 74...short QQQQ

- When the RSI 5 closes an hourly bar below 30...cover QQQQ

Trades on the hourly and the first hour is 9:30-10:00am EST.

Looking to buy QQQQ puts just after the open

Subscribe to:

Posts (Atom)