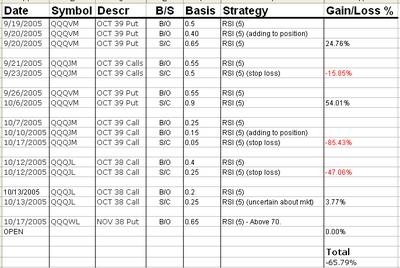

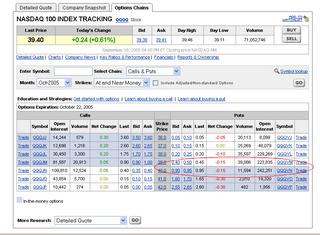

The market finally decided to break out of the recent trading range and went up up up. Not good for my put position. The issue was the lame range the last week and not getting a confirmation to close to Put/short position. However, RSI(5) was VERY close to being below 30 on the hour and I did set a limit order to sell at $0.75 but didn't get a fill. Mostly I was expecting a bigger move down but we didn't get it. The Q's were around $38.45 yesterday and that's when I should have taken my profits and closed this dreadful short that just wouldn't materialize.

The RSI(5) system doesn't really afford the chance to let the profits "Run" so when I got the $0.20 to $0.25 profit I should have taken it. Currently Q's are up AGAIN today and currently around $39.36 and hitting a high of $39.45. Some are mentioning that this current run up is due to end of month and funds/institutions trying to prop up their value. Who knows.